A 3 month outlook for Bund futures

1st July 2015

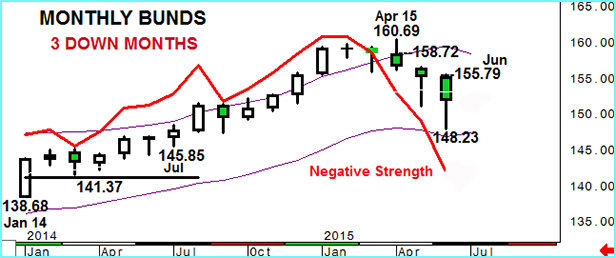

We look for lower levels to develop in Bunds after the Greek issue has calmed, one way or the other, with downside scope to 148.23, 145.85 or even towards 141.37.

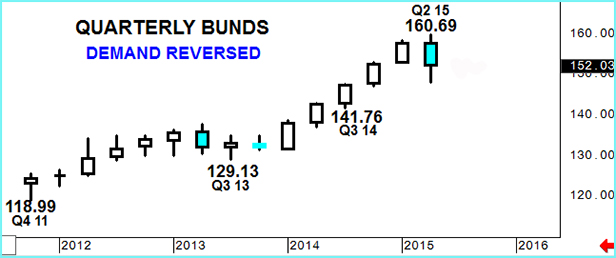

A sequence of 5 positive quarters ended over the last 3 months. Early Bunds gains proved limited and sentiment reversed sharply. The preceding quarters entire upside was lost – a Bearish Outside Quarter – as each month produced net losses in volatile price action. Although the lows were not maintained, technical indicators are increasingly negative.

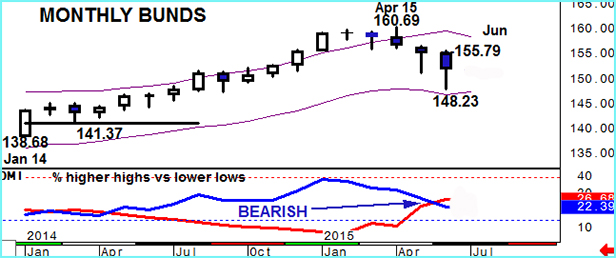

Strength indicators were already showing some bearish divergence as we went into Q2 but that has been emphasised as the decline in this indicator, RSI, accelerated. Slow Stochastics also gave a negative crossover after April’s decline and trend following programs (DMI) also produced a ‘Dead’ cross after June’s fall.

This latter signal is a lagging tool but does act as an excellent confirmation and June’s confirmation that price action is creating a greater % of lower lows as measured against higher highs was the first negative situation since April 2014.

Finally in Yields, June’s rise to test 1% was the 3rd successive up month since January 2011.with Momentum there gaining ground aggressively.

Currently we look for rallies to be curtailed by 155.79 and the stop is assessed as 158.72.