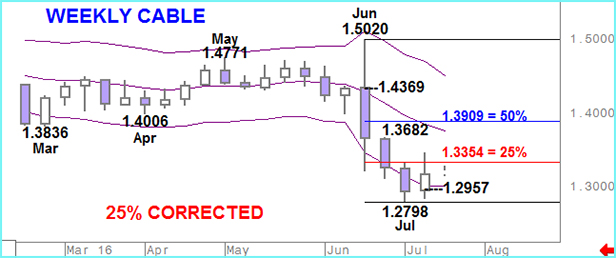

CABLE – Rally Over?

18th July 2016

..2 negative weekly performances in succession followed the volatile and negative aftermath of the Brexit vote. The uncertainty that surrounded all markets, but especially UK markets, was dissipated to some degree last week as traders calmed and a new authoritative Prime Minister (coupled with BOE comments) took some of the immediate pressure off.

From a technical point of view it is interesting that the in CABLE found fresh selling interest above a 25% correction point and also the trend defining 13 day moving average.

That point held, on a closing basis, on each of the last 3 days of last week with a second firm rejection of the daily highs on Friday creating a Bearish Dark Cloud pattern on daily candle charts.

So, does this signal the end of the CABLE rally?

What is clear is that there is still likely to be uncertainty. This is not something the market likes and so the bigger risk for those trading CABLE is on the downside and the key level to watch is 1.3122. This is last Tuesday’s Marabuzo line and a close below that point, which is our favoured direction, should see the market focus on 1.2998 then 1.2851.

For a free assessment of our full analysis service please click HERE