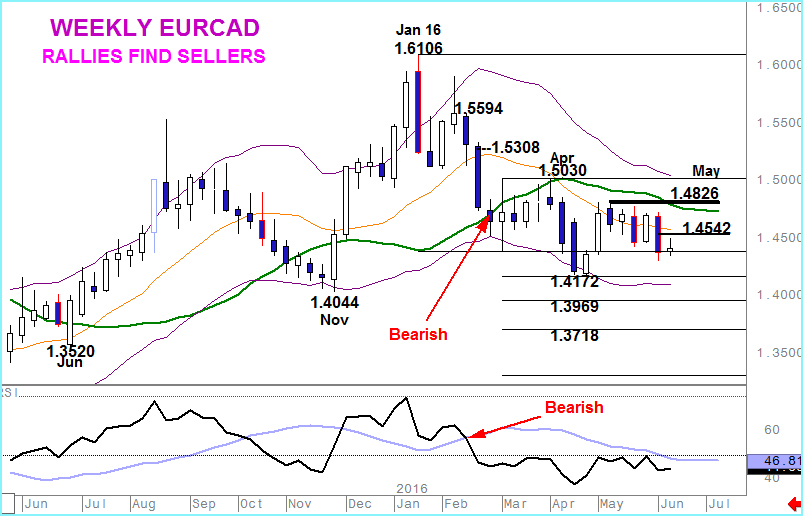

EURCAD- Looking for deeper downside

15th June 2016

…Renewal of selling pressure has scope to take EURCAD to retest April lows.

After EURCAD topped out in January, the following month saw a break of the RSI below it’s moving average, then a move below the mid-point of the weekly Keltner channel and finally losses through the 21 week moving average.

RSI signals have been negative since and although April saw a firm bounce from the lows – strong enough to trade above the mid-point of the channel- the key 21 week moving average went untested.

The last 6 weeks have seen consolidation but last week’s decline renewed selling pressure is expected to deepen in the coming weeks with April’s lows the current focus.

The last 6 weeks have seen consolidation but last week’s decline renewed selling pressure is expected to deepen in the coming weeks with April’s lows the current focus.

Last week’s Marabuzo line (1.4542) is likely to attract fresh sellers and although the current stop for shorts has to be May’s 1.4826 top, a weekly close above the 21 week line is a more conservative point to watch.

On the EURCAD downside I expect the focus to be on projected levels of 1.3969 or even 1.3718.