Posts tagged 'Bunds'

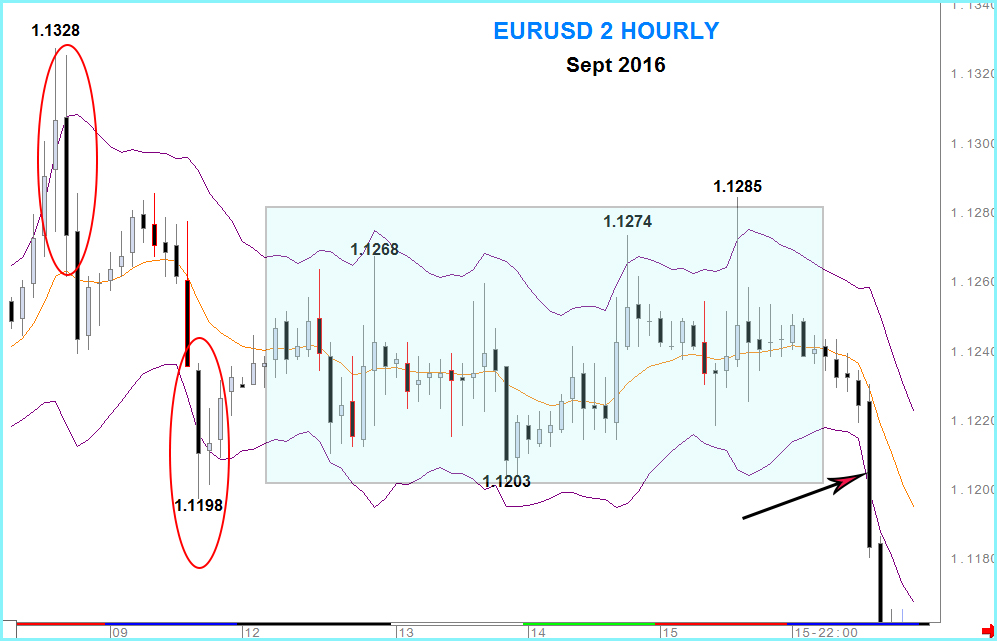

This article is about Keltner channels and how, using them as trend indicators, they can aid trading on almost any time scale.Firstly we’ll cover the theory then practice of how I use them in analysis across the asset classes with some recent examples to see how they work.Keltner channels can be invaluable as a tool for... read more

I've pointed out on these pages before how useful both RSI and Keltner channels can be to traders across the asset classes. What I'd like to show today is how the two indicators can combine in another method of application for trading. This article is going to look at using Keltner channels around the RSI indicator rather than... read more

BTP's - Sentiment remains NegativeAfter falling almost 14 points from August’s high the BTP market has been trying to rally since November’s low. This week’s gains have the potential to produce a 3rd up week in a row.However, the bounce remains a limited one in our view with last week's demand stalling near a 25% correction... read more

Where does demand take Bunds next?For a change we'll take a look at the direction for sentiment in Bunds from a yield persective. As you can see from the chart this year has been dominated by a decline in rates with this week's movement taking prices below February's low. The strength of this negative trend can... read more

We look for lower levels to develop in Bunds after the Greek issue has calmed, one way or the other, with downside scope to 148.23, 145.85 or even towards 141.37. A sequence of 5 positive quarters ended over the last 3 months. Early Bunds gains proved limited and sentiment reversed sharply. The preceding quarters entire upside was... read more

As those of you who’ve read our analysis on a regular basis will know we very often refer to Keltner channels as a way of defining a trend. This applies whether it’s a long term or intraday trend and their effectiveness, when used in conjunction with other technical indicators and in the context of market price... read more

Keltner channels were originally developed by Chester Keltner in his 1960 book ‘How to Make Money in Commodities’. The basics have been amended since and the accepted default method is currently that the bands are based on the average true range (ATR) and calculated over 10 periods. This ATR value is then doubled and added to... read more