Commentary

3c Analysis Commentary Page - Adding Value

On these pages we will expand upon some of our forecasts, talk about other moving markets from a technical analysis perspective, explain technical analysis tools from a practical perspective and include guest commentary from a variety of roles across the financial markets.

Tuesday 21st Nov - As you will have seen the negative concerns expressed in this post have been confirmed with a close below the average. Our medium term bias for CADJPY has changed to bearish with initial targets of 86.45 and 85.47. CADJPY RSI signals produced a negative (dead) cross 3 weeks ago. That move was not... read more

Signals for sentiment for NOKSEK have been bearish since March. Rally attempts attracted fresh selling interest at lower levels during that time. That is until the last couple of months where, despite being unable to test the key 21 week offset moving average, gradually higher lows have developed.That, coupled with a positive break of the RSI... read more

Courtesy of: Visual Capitalist All of the World’s Money and Markets in One VisualizationThis infographic is the updated version of our best-known piece from The Money Project, an ongoing collaboration with Texas Precious Metals. It was first published in late 2015.Millions, billions, and trillions…When we talk about the giant size of Apple, the fortune of Warren Buffett, or the... read more

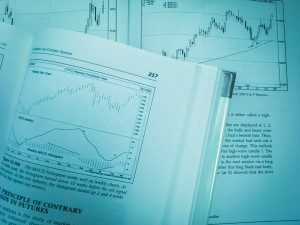

My Favourite Books on Technical Analysis.When I first got into Technical Analysis the only real way to learn was by reading books by those technicians that had started the ball rolling in modern times, and by playing with simple indicators on graph paper. The arrival of dealing room computers and then software accelerated the emergence of... read more

US$ INDEX, still long-term bearish, but looking to trade bounceWe have been bearish of the $Index throughout 2017 and in our last update on May 11th we emphasised this view by highlighting the inverse relationship between US interest rates and the US$ exchange rate.The sell-off has also come from close to a 62% recovery to the... read more