Using Keltner Channels

18th November 2019

This article is about Keltner channels and how, using them as trend indicators, they can aid trading on almost any time scale.

Firstly we’ll cover the theory then practice of how I use them in analysis across the asset classes with some recent examples to see how they work.

Keltner channels can be invaluable as a tool for increasing profitability. Obviously they cannot be taken in isolation as perspective is absolutely vital when applying any technical study.

The Keltner channels were originally developed by Chester Keltner in his 1960 book How to Make Money in Commodities. The basics have been amended since and the accepted default method is currently that the bands are based on the average true range (ATR), but the ATR is calculated over 10 periods. This ATR value is then doubled and added to a 20 period exponential moving average for the plus band and subtracted from it for the minus band. (The multiple default differs from platform to platform but the variations are generally between 1.5 and 2.5).

Basically the smaller the multiple the more trading signals are provided. For a long-term trader this is something to avoid and so he/she would err towards 2.5. For the intraday trader though more trading signals, as long as they’re filtered, are good so the bulk of today’s charts will use the 1.5 multiple.

Once the Channel is drawn it can be used as a trading tool regardless of whether the market is trend or range bound. This, in itself, is unusual as most technical indicators provide signals in markets that have a defined direction and when the market is trendless their use is significantly diminished or can even be counter-productive. Before we look at both situations and the practical application of the Keltner channels, let me just point out the personal adjustments I make to the default inputs.

In Practice with personal adjustments

The default uses exponential moving averages and although have experimented with Simple Moving Average I have reverted to produce more consistent results.

I have though altered the moving average from 20 to 13. The reason here is that I am a firm believer in Fibonacci numbers and that gives an alternative of 8 or 13. Back testing has indicated that a consistent use of 13 provides the best results. Nonetheless, this is something that everyone should experiment with.

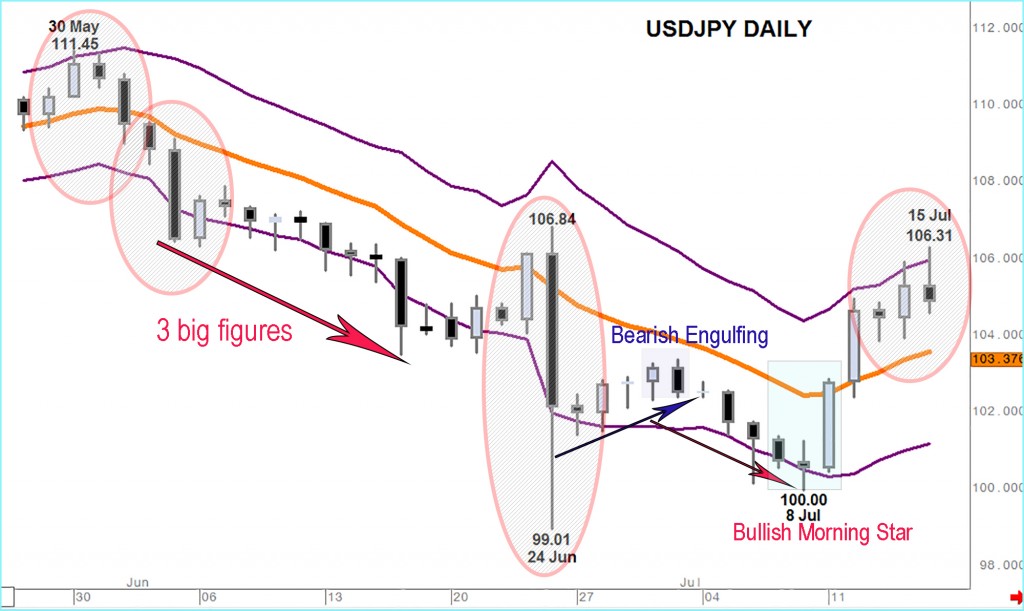

The first example we will look at is a Daily USDJPY chart.

And we’re looking at June through to the middle of July this year and a decline of more than 11 big figures during that time and even at first glance you can see how the Keltner channel and the 13 day mvg avg act as a great indicator of trend – keeping positions short or square early July’s rebound from the psychological 100.00.

The first point to note is the extreme high, after gradual gains during May, at the end of the month. Prices are still close to the top of a rising Keltner channel and the trend therefore positive. But May ended with a Dark Cloud cover pattern on daily candle charts and this warning was followed at the beginning of June with a move down through the 13 day mvg avg and mid-point of the Keltner Channel.

This led to 2 more solid down days which, most importantly, took USDJPY to the lower band of an increasingly negative channel.

It is when spot prices are ‘hugging’ the lower end of the Keltner channel that the trend is emphasised. During the next 9 days prices fell by another 3 big figs before the market consolidated and attracted profit taking. I think it is likely that the rally would have been contained by the mid-point of the channel under normal trading conditions.

But this is where the real world enters sometimes and you see how the exceptional circumstances of Brexit impacted on USDJPY here. Massive extremes as the results of the vote was anticipated then reacted to. What is interesting is that after the shakeout the market returned to the underlying negative trend marked by the channel.

The bounce from the lows was very limited over the next 5 days and ended with a Bearish Engulfing pattern comfortably short of the 13 day mvg avg. That failure led to another move lower marked by a tracking of the channel base which took USDJPY to the emotive level of 100.00 – under normal trading conditions rather than the Brexit spike.

It is at that 100.00 point that enough investors see value to reject the lower end of the Keltner channel, create a Bullish Morning Star pattern and break through the mid point of the channel/13 day mvg avg.This renewal of buying interest then takes USDJPY to the top of what is now a positively trending channel and the cycle is reversed.

You can see from those points how the Keltner channel helps determine a trend, confirms the strength of a trend and also provides levels to consider entering fresh positions.

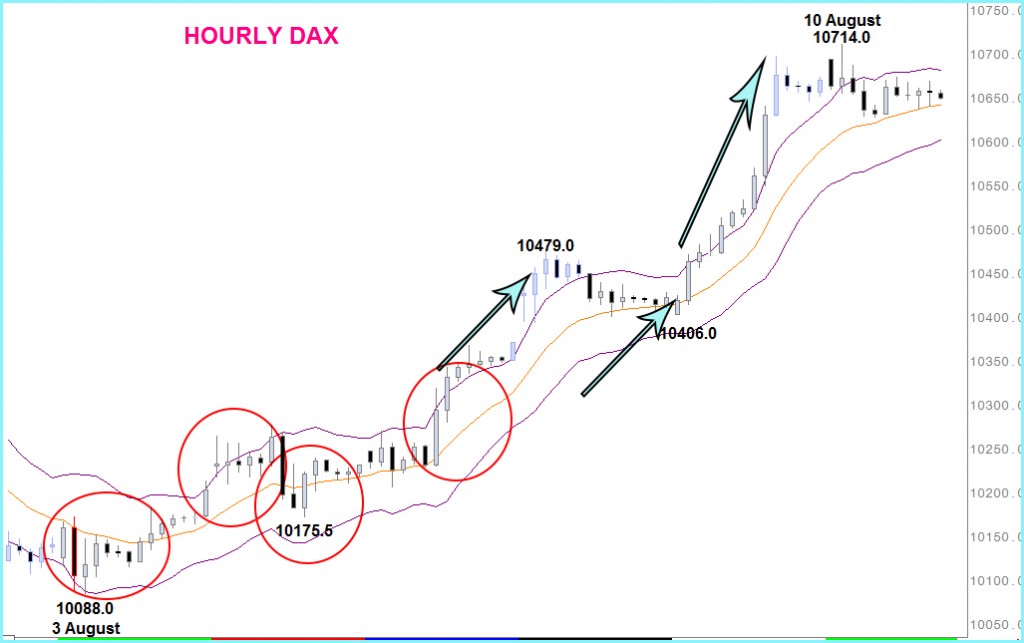

DAX Hourly

Now lets take a look at the DAX future and drill down the time perspective to 1 hour.

This period between the 3rd and 10th August saw a solid appreciation in the futures contract and the Keltner channel was an excellent indicator of how strong the positive trend was.

The market based in early August after a preceding down trend. This was initially marked by consolidation at oversold extremes but gradually higher intraday lows eventually led to a close above the midpoint of the channel.

That was a clear indication that the down trend had ended, although we still looked for confirmation of a new positive bias.This confirmation was provided by a move to the top of an increasingly positive channel. To be fair net upside was limited and led to a sharp setback.

This setback was the only one during the time covered in this example that gave a false signal, closing below the mid point (13 hour ma) although buying interest was soon reasserted.That mid-point acted as a support for almost a day, then translated into a platform for a move to the upper band of an increasingly positive channel.

The move outside of the top of the channel emphasises the strength of the trend and gains of more than 140 points was posted.The eventual setback from overbought extremes was limited by the mid point of the channel – another reflection of the strength of the trend. The only prints below that point was a 7am open that immediately found buyers back above.

The buying from that point then took DAX futures back the top, and through the top of an aggressively improving Keltner channel for one last powerful move higher.

I think you will be getting the picture now about how useful Keltner channels are in identifying trend and also potential corrections levels but we move on to live charts and see how Keltner channels are fitting in lets take a look at a trendless market.

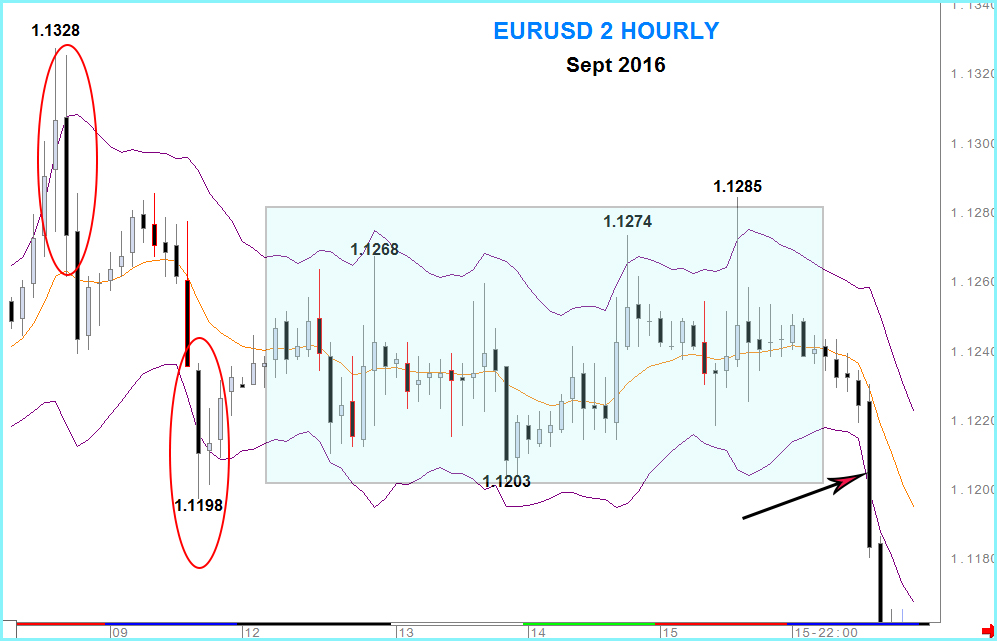

Our final example shows a broad range trading situation in 2 hourly EURUSD at the end of a Bull Trend and before a Negative trend develops.

2 sharp, failed, spikes outside the top of the rising Keltner channel, and the formation of a Bearish Engulfing/Outside day marks the end of the preceding positive trend. Confirmation is provided by the next days decline through the mid-point of the channel.

The move to the bottom of the Keltner channel seems to indicate a new bearish bias but there is no follow through. In fact the market recovers, very gradually to the mid-point of the channel and the 13 period mvg avg.

There then begins a long period of consolidation with the Keltner channel broadly flat and rare tests of the extremes being firmly rejected. In other words the market does not hug the channel edges and so a trend if not established. In fact a more aggressive trader would use those rejections to position himself the opposite way.

This consolidation ends and a new bear trend begins with this sharp deterioration. The lower end of the Keltner lines is exceeded with a close below, rather than a rejection, given the bearish signal.

So you can see that although Keltner channels are an excellent method identifying trend they can, unlike so many other technical signals, provide trading opportunities in trendless markets.