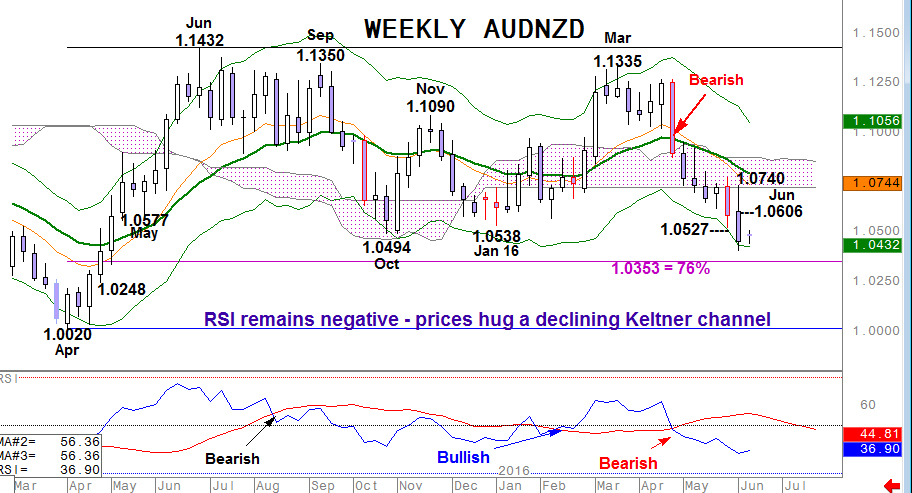

AUDNZD – Tracking Keltner channel lower.

13th June 2016

AUDNZD …. Trading was volatile in AUDNZD last week with initial upside of over a big figure aggressively reversed with prices falling more than 300-pips from the high. But the latest fall emphasises a negative trend that has been clear since the end of April, but has accelerated over the last 2 weeks – now tracking the lower end of a negatively trending Keltner channel – to take AUDNZD to the most negative levels traded for a year .

Importantly, both the spot price and RSI remain comfortably below their key moving average levels – breaks of which triggered bearish sentiment – with the weekly Ichimoku Cloud now capping rallies.

Our signals for sentiment remain negative and I think any profit taking rallies back near 1.0527 will find fresh selling interest with only a move above 1.0740 being regarded as positive (that risk level will decline in the shape of the 21 week moving average as time passes).

Our signals for sentiment remain negative and I think any profit taking rallies back near 1.0527 will find fresh selling interest with only a move above 1.0740 being regarded as positive (that risk level will decline in the shape of the 21 week moving average as time passes).

On the downside the market’s focus is expected to be on a 76% correction point, 1.0353, where some profit taking would be expected but below that point there is scope for acceleration towards 1.0248 or even the 2015 base near Parity.