CHFJPY – Failed Rally Confirms Negative Trend

29th June 2016

.. I last wrote 3 weeks ago on the continuing downward trend in CHFJPY. We’ve had some increased volatility since after the Brexit vote but this has only served to emphasis the underlying negative trend.

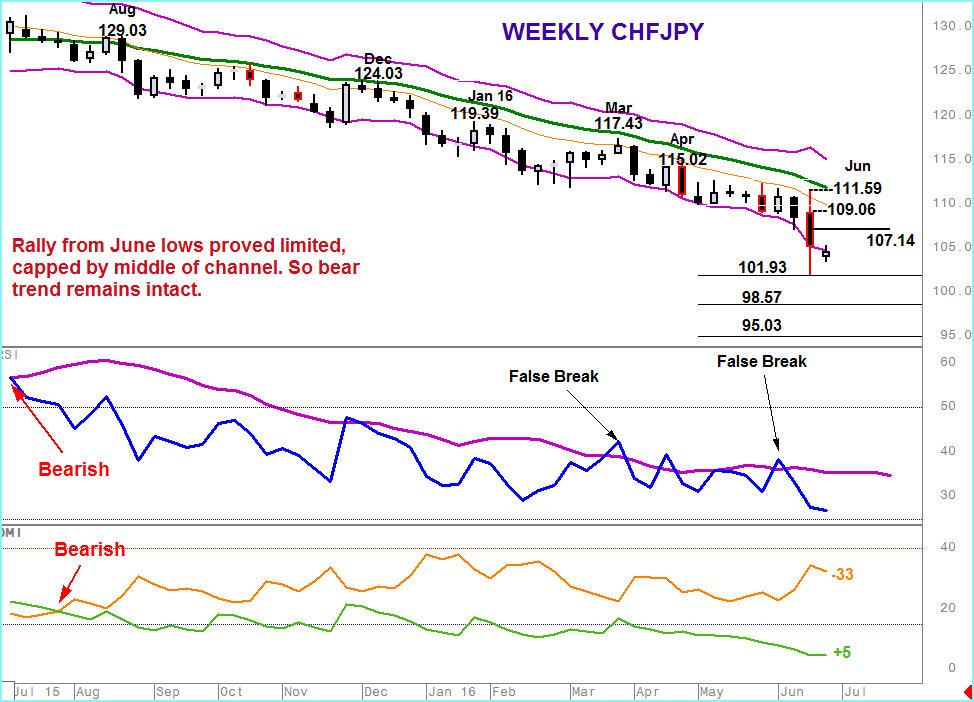

Friday’s aggressive bounce took CHFJPY back to the mid-point of the negatively trending Keltner channel but, importantly, lacked the momentum to test the 21 week moving average.

The lows of the subsequent powerful deterioration of almost 10 big figures were not maintained – finding profit takers at a Fibonacci extension point of 101.93 – but the bounce was, and has remained limited.

The negative trend can also be identified by the RSI indicator that gave a negative trigger in July 2015 and, allowing for unconfirmed false positive break, has pointed downward since. This applies also to the DMI indicator (a statistical method of measuring higher highs against lower lows.

With these factors in the background and CHFJPY still tracking the lower end of a falling weekly Keltner channel we continue to look to the downside with 98.57 and 95.03 valid Fibonacci extension targets.

Profit taking rallies should be capped near 107.14 (where selling interest can be expected) with only a move above 111.59 being positive, although this risk level will be amended as the 21 week average descends.