Commentary

3c Analysis Commentary Page - Adding Value

On these pages we will expand upon some of our forecasts, talk about other moving markets from a technical analysis perspective, explain technical analysis tools from a practical perspective and include guest commentary from a variety of roles across the financial markets.

The negative trend for USDCAD is nothing new. Its been the dominant feature of 2016 - countering the strong rise that marked the latter part of last year. The first 3 weeks of this year continued the gains but the turn since has been aggressive.A look at the chart below shows the strength of both trends.If... read more

I have written on these pages before about the benefits of using Keltner channels to highlight trends across asset classes and time periods.Here we're going to take a look at intraday trading in Gilts and where the current upside is likely to go.Firstly to establish a background, the chart below shows Gilts from 5th February to... read more

On January 26th we wrote about the negative trend in CHFJPY and how our technical analysis indicators pointed to still lower levels.Our initial target was 111.87. This has yet to be reached as our report was followed by a profit taking bounce.However, that rally was limited to one week and since that time sellers have dominated... read more

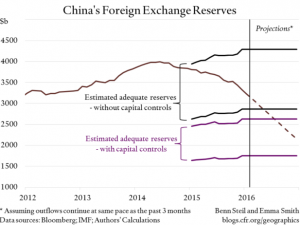

Could China Have a Reserves Crisis?by Benn Steil and Emma SmithLast summer, U.S. lawmakers were condemning China for pushing down its currency, arguing that it was still “terribly undervalued.” But those days may be long gone. Chinese and foreigners alike have been stampeding out of RMB, leaving the Chinese central bank struggling to keep its value... read more

This year has seen a strong trend higher across all the Fixed Income futures markets. Identifying the trend has been relatively easy using moving averages and Keltner channels but how to predict upside levels, especially with new contract highs being posted in recent days?An extremely useful tool that we turn to is Fibonacci extensions. And to... read more