Posts tagged 'GBPUSD'

..2 negative weekly performances in succession followed the volatile and negative aftermath of the Brexit vote. The uncertainty that surrounded all markets, but especially UK markets, was dissipated to some degree last week as traders calmed and a new authoritative Prime Minister (coupled with BOE comments) took some of the immediate pressure off.From a technical point of view... read more

Project Fear - Implications of Brexit... a guest article.by Jeremy RaybouldPrivate Equity and Alternative Investments Specialist/Investor Relations and Equity Fund Distribution. Partner at Lancea LLP Brexit and Binary: when it is or when it isn't - or neither?The UK's EU referendum is, on the face of it, a binary event: either yes or no. Either of the 50:50... read more

....The background to medium term analysis to CABLE has to be the bullish inverse Head & Shoulders pattern that the chart below shows.This year's trading has been dominated by downside attempts in January, March and April that formed the three bases that create the Head & Shoulders formation. This pattern very often confirms a strong change... read more

...Our bearish forecast for Q4, following a strong decline in the preceding 3 months, was justified. Sellers continued to dominate, although with reduced momentum, after a limited profit taking bounce in October and our first downside target was met. Although Dec’s lows were not held and 5th down month from the last 6 and negative technical... read more

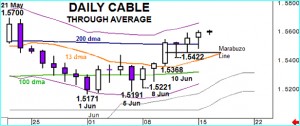

A sequence of 3 lower CABLE highs ended last week. The preceding week's stalling at a 50% correction level proved crucial and as buying became more pronounced. In fact gains of almost 3 big figures turned weekly sentiment clearly positive, especially with the market bought at higher levels on each of the last 6 days and... read more

Keltner channels were originally developed by Chester Keltner in his 1960 book ‘How to Make Money in Commodities’. The basics have been amended since and the accepted default method is currently that the bands are based on the average true range (ATR) and calculated over 10 periods. This ATR value is then doubled and added to... read more