10 Major Behavioural Traits of Successful Traders

28th April 2016

The 10 Major Behavioural Traits of Successful Traders

a guest article by Steven Goldstein

The questions I probably get asked more than any other are: What makes a good trader? Answering this in detail is not easy, however in this article I explain what I think are the 10 major behavioural traits of successful traders.

All traders start out with the best of intentions, however too often their focus becomes misdirected, with too much attention spent looking at achieving short-term goals or projecting themselves and not enough focus spent looking at the process and reflecting on that. For the trader who wishes to develop themselves toward adopting the attitude and mindset needed for success in the financial markets, I would suggest ‘aiming’ towards a goal of trying to implement, practice and incorporate the 10 traits within their general approach to their work. There is no hierarchy to the traits, and in many cases, the behaviours and practices associated with one trait, help to re-enforce another: The ultimate goal of all these traits is to help the trader develop their self-efficacy and their belief in their ability to succeed as traders.

All traders start out with the best of intentions, however too often their focus becomes misdirected, with too much attention spent looking at achieving short-term goals or projecting themselves and not enough focus spent looking at the process and reflecting on that. For the trader who wishes to develop themselves toward adopting the attitude and mindset needed for success in the financial markets, I would suggest ‘aiming’ towards a goal of trying to implement, practice and incorporate the 10 traits within their general approach to their work. There is no hierarchy to the traits, and in many cases, the behaviours and practices associated with one trait, help to re-enforce another: The ultimate goal of all these traits is to help the trader develop their self-efficacy and their belief in their ability to succeed as traders.

Trait 1) Successful Traders Learn from their Mistakes.

Trait 1) Successful Traders Learn from their Mistakes.

Most successful traders have been through a painful learning process, usually many times over. Whilst to a degree all people learn from their mistakes, successful traders seem to learn better than others. Whilst those who are really successful keep on learning, never ever thinking they ‘know it all’. – In trading; the moment you think you know it all, pre-empts the moments when you find out that you don’t.

Possibly the most successful hedge fund trader of the past few decades, Ray Dalio, founder of Bridgewater Associates, emphasises this aspect of trading into the way he works, and has embedded it into the culture of the business he founded. Dalio believes that mistakes are the greatest learning tool we have and at Bridgewater it is a key principle that ‘it is acceptable to make a mistake, but never acceptable not to learn why or how you made the mistake’.

Helpful behaviours to support development of this trait: Keeping records/journals of actions, thoughts and feelings. Reviewing and evaluate actions and behaviours. Be willing and open to seeking and receive feedback. Practice developing clarity of mind and the ability to objectively assess your own behaviours. Develop abilities for objective thinking and reflection. Formulate a growth and continual development plan. Monitor growth progress and development.

Trait 2) Love of Trading and a Competitive Will to Win.

Trait 2) Love of Trading and a Competitive Will to Win.

The most successful traders love trading, they have developed a real passion for it. There is not much chance of being successful as a trader if you don’t have a strong desire and passion for trading. – Don’t get me wrong, most people get into trading for the money, however at some point this transforms into a real interest and a passion. – When I ask successful traders what is it that motivates them to continue to be a trader, rarely is it the money that is mentioned; more often it’s a love of the job, and various other aspects that go with that.

Helpful behaviours to support development of this trait: Developing one’s self-efficacy. Immersing oneself in learning, training and personal development. Clarity over long-term goals and objectives. Spend time and with other people in the industry who are passionate about trading.

Trait 3) Trading Style Congruent to a Person’s Personality and Character.

Trait 3) Trading Style Congruent to a Person’s Personality and Character.

The top traders have a trading style suited and congruent to their personality and character, it is a style which they have moulded around their own particular strengths, and which works to offset weaknesses and flaws they possess.

It is unlikely the novice trader is going to start with the same style and approach to trading that they will eventually settle down with. At first they are likely to adopt the style of their teacher, trainer or mentor, however over time they will refine and alter it to fit to their character and personality.

To achieve this one must have a high degree of self-awareness, including the ability to achieve honest self-appraisal and reflection. This can take many years, and a requires a high degree of honesty, something not always easy when one desires are telling is driving a person in a direction which may blind them to their reality.

In my work with traders I have pioneered the use of ‘Risk Profiling’ to help traders better understands their personality traits, and the style and behaviours that their personality is most suited to. One of the biggest problems traders have is when they are using an approach or style which is not best suited to their personality. I compare it to an athlete who chooses the wrong event for their body type. I find that most successful traders are employing a style an approach which suits their personality and thus gives them a defined edge they can work. The consequence of this is that traders of all types can achieve success, whether they are highly risk-adverse, highly risk-seeking, logical and methodical or intuitive and emotional.

Helpful behaviours to support development of this trait: Conscious alignment of approach to suit strengths and allay weaknesses. Develop mindful awareness of one’s self, character and behaviours. Willingness to seek and receive feedback. Appraisals/personality Tests/ Risk Profiles. Set goals to include congruence to strengths and character traits.

Trait 4) Reduction of Anxiety and Stress.

Anxiety and stress are part of the territory in trading, there is no escaping this, the very nature of trading requires one to immerse themselves in uncertainty. Anxiety and stress affects people in different ways and at different times; it has a distorting effect on the way we see and perceive the world and our immediate environment, and alters our ability to make sound judgments, and appropriate decision. Successful traders will have developed various tactics which enable them to reduce anxiety levels. This will include preparation and planning of trades, reducing the need for ‘seat of the pants’ trading, or if that is there style, ensuring they are appropriately engaged for ‘seat of the pants’ trading. They also manage their personal resources, such as time, physical and mental energy, to help stay on top of the market and reducing the likelihood of ‘rushes of blood’ to the head.

However, keep in mind that complete removal of stress and anxiety should not be an aim. Stress serves a purpose; it keeps traders alert to threats, danger and opportunity and helps one’s creativity to flow. There are times when trading at very low stress levels can be highly unproductive and lead to ‘trading with abandon’: This sort of behaviour can sometimes be seen when a trader has had a good run, and is a major cause of traders giving back profits repeatedly. Some traders will take a break from trading after a good trading run, in order to avoid just this situation.

Helpful behaviours to support development of this trait: Ability to be objective about one’s self. Engage in activities which clear the mind; physical and mental activities. Keep an inspirational reminder article or object present to ground you and break harmful/negative thought process. Make time away from trading. Talk to people, do not lock yourself away. Share your thoughts and feeling with a sympathetic listener, close friend, spouse or partner. Find ways to suspend self-judgement. Write your thoughts and feeling in a journal/diary. Learn to read bodily cues and signals.

Trait 5) Humility and Humbleness: Successful traders curtail their ‘Ego’ and ‘Pride’.

How does one do justice to such a huge topic in just a few short paragraphs? Just about every major story of Financial Market excess and collapse has, closely entwined in its narrative, tales of excessive egotism and hubris: The collapse of Lehman Brothers, the fall of LTCM, the Enron scandal, the decline of Amaranth Advisors; the largest ever hedge-fund failure. Whilst these are clearly examples on a much larger scale, the twin dangers of ego and excessive pride affect most traders at some time: I have seen people’s ego’s and pride get them into some horrendous trading messes, and I myself have not been immune to this happening more times than I perhaps care to admit.

The opposite of Egotism and Pride, in this sense, are Humility and Humbleness. These two traits are not ones that the common media depiction of successful traders as ‘Master of the Universe’ would have us recognise. However, these are words that I associate with many of the most successful traders I know.

One of the greatest errors many traders commit is to allow their trading and their beliefs or views on the market to become entwined with, and an extension of, their egos. The same can be said with regard to ‘pride’, though closely related to ego, pride is slightly different, and though considered a positive emotion, excess pride (hubris) can be a major impediment to successful trading. It is vital that a trader can admit they are wrong, capable of being wrong and that they have limitations and flaws: Failure to admit to being wrong, or even being capable of being wrong, can lead to traders somehow trying to exert their will over the market or holding onto positions rather than crystallise a loss.

Helpful behaviours to support development of this trait: Keep sight of your original goals, this includes recalling that ‘Trading is not about being right or wrong, it’s about doing things right and making money’. Listen well and be willing to seek open and honest feedback. Ensure you look into and learn from mistakes. Try and be an optimalist and not a perfectionist; an optimalist admit to flaws, failings and errors, their working style is flexible. Be mindful and conscious of not imposing your ego on people. Avoid boasting and building your-self up to other people. Listen to people, ask questions, try not to enforce your views and opinions on people. Find ways to suspend self-judgement. Avoid criticising and judging other people. Practice ways to develop objective thinking and reflection.

Trait 6) Planning, Preparation, Patience and Discipline.

It is hard to find a book on trading that does not stress these virtues. Yet actually following through and exercising these virtues within one’s trading is one of the hardest things to achieve on a regular basis. All the hard work and preparation which goes into one’s work can be lost in a few moments of ill-discipline.

Successful traders place significant emphasis on these aspects of trading, they think through what they do thoroughly, planning and preparation help build a solid foundation which allows them to exercise the necessary patience and discipline needed; it also helps facilitate a reduction in uncertainty and thus helps reduce anxiety and stress levels. Let us not however imagine that successful traders are anything like perfect in this area, they aren’t, however many of them will display higher propensities to display these skills than the majority of traders. It is nonetheless this propensity to perform these skills and attributes, which means that when opportunity or even luck present themselves, they are better prepared to take advantage, and when unfavourable outcomes occur, they are more resolutely able to deal with these situation. As the great South African golfer Gary Player once famously said, ‘Luck is what happens when preparation meets opportunity’.

Helpful behaviours to support development of this trait: Keep sight of your main goals, this includes recalling that ‘Trading is not about being right or wrong, it’s about doing things right and making money’. Invest time to develop appropriate behaviours, invest time in putting those behaviours into practice. Review your progress toward development goals. Develop a structure around your trading. Develop a strategic perspective, ensure you are consistent in applying the tactics needed for the strategy.

7) Respect for Risk and Uncertainty.

Successful traders have a huge respect for risk and an appreciation for the dangers of uncertainty. There is a subtle difference between the two: Risk is a subset of uncertainty, one can assign a value to risk, but not to uncertainty. As an example; if the market dropped tomorrow and my position was stopped out, then I would lose $X: that is my risk. However, I do not know if the market will drop tomorrow or by how much, and if so whether it will hit my stop: that is uncertainty. Some people try and price uncertainty, which they mistake for risk, however, it is hard to truly put a price on uncertainty. This point is admittedly contentious and some may debate the simplistic definitions, however I do believe that attempts to price uncertainty typically end in disaster. People thought they had valued uncertainty correctly at LTCM, and the lessons of this were quickly forgotten as people also thought they had correctly priced uncertainty ahead of the Global Financial Crisis.

Top traders embrace risk, and respect uncertainty, they know crucially that they do not know what comes next and are at best making educated guesses. Successful traders are not gamblers, the only casino games successful traders usually play is poker, they usually do not see poker as gambling, in poker they have the ability to shift the odds in their favour, in all other casino games, the odds are too heavily stacked against them. There has to be positive expectation of a favourable outcome, not merely an assessment of market direction.

Helpful behaviours to support development of this trait: Structured approach to Trading, Developing a strategic perspective. Develop a rule base for risk. Plan trades and include risk in trade evaluation. Develop an approach for assessing risk/reward. Ensure you are consistent in applying the tactics needed to enforce the strategy. Evaluate your performance in risk assessment. Monitor your progression.

Trait 8) Develop effective Risk/Money-Management Practice.

Successful traders see their trading as a business. – It would be foolish to enter into business undercapitalised and without sufficient liquidity. Many do, but that is tantamount to a gamble, some are lucky enough and survive, but they owe their survival to good fortune. – Good fortune can only however be stretched so far, running a business requires careful and tight management of costs and expenditure; prudent business owners do not put all their ‘eggs’ in ‘one basket’. – Trading should follow the same principles.

Successful traders devote a lot of time to these issues, they know that failure to adhere to basic principles of money management leads to ruin. It is surprising how many traders ignore or forget the basic principles of money-management. Simple acts like; not placing stops, removing stops, or placing too large a trade, can cause losses to multiply and greatly increase the risk of failure. Taking profits too quickly means they fail to cover the costs of their losses and many traders focus on how much they believe they can make, and forget the basic principles of assessing how much they could lose. Some traders run their trading on Martingale principles, something which only has to fail once to lead to wipe-out.

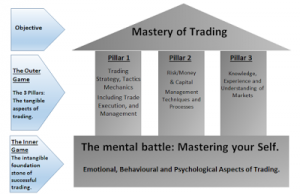

One final point: Money-management is the unexciting, somewhat boring aspect of trading, however this is so crucial and important that it should carry equal weight with other key aspects of trading. This is where many of the ‘excitement seekers’ or ‘creative types’ fall foul. Too often people put their energies into assessing market direction, and where to enter and exit the market, they completely ignore or give scant attention to money-management. The image below emphasises the importance of accounting for ‘Money and Risk Management’ within a trading strategy.

Helpful behaviours to support development of this trait: Have a well-developed structured approach to trading. Developing a strategic perspective to your trading. Develop a rule base for risk. Plan trades and include risk in trade evaluation. Develop an approach for assessing risk/reward. Ensure you are consistent in applying the tactics needed for the strategy. Include this element of trading in your personal development plan. Understand the need to size trades according to risk of loss.

Trait 9) Successful Traders focus on making money, not being right.

Successful traders realise that they are not in control of the market (uncertainty), they view the market as a force of nature without an agenda. The only thing they can control is their own actions, actvities, behaviours and emotions. The top traders know they are not infallible. All humans have biases and limits to cognitive abilities, anyone is capable of being swayed or easily distracted, everyone’s personality is different and brings different influences to bear on their decision-making. However, successful traders work around these factors, they accept that losing is part of winning, and they know their job is to make money, not to be right. It is another of the paradoxes of trading: Successful traders can lose money, get markets wrong, but still consistently come out on top. Failing traders can have wins, get markets right, and still consistently underperform.

Successful traders win the Inner Game, (see figure 1 above), they apply focus and concentration commensurate with what is needed: They will display realism not fantasist ideas hoping that markets turn their way, or bemoaning some sort of conspiracy. They will stay in the here and now, not dwelling on past victories or defeats, or celebrating as of yet unearned future victories. Importantly they develop a strong relationship with losing, some of even attested to me that they ‘love’ their losses. It makes them easier to accept, particularly if they can contextualise them as just part of the process of winning.

Helpful behaviours to support development of this trait: Focus on long-term goals and objectives. Focus on strategies and tactics to achieve long-term goals. Reviewing and evaluate actions and behaviours used within your activities. Willingness to seek and receive feedback. Step back from the fray. Practicing ways to clear mind and develop objective thinking and reflection.

Trait 10) Achieving Balance and Perspective in Life.

Successful traders try to keep their external lives in balance and uncomplicated. They have a holistic view of their lives, whereby trading is a part of their lives, if the other parts of their lives are out of balance or synch then this will affect their trading, and likewise when their trading is out of balance, then this can have an effect of the other parts of their lives.

Many traders will look to remain fit and healthy and avoid doing things to excess. Likewise, they try to keep family matters as uncomplicated as possible. Their own investments tend to be safe and relatively un-complex. All of this helps ensure a clear and uncluttered mind in order to focus attention and resources on trading.

It is easy to forget the human element to trading, as people try to add further to their tools, electronic systems, instruments and technical capabilities. However, it is our human aspects which make us successful, the great British Army Officer Field Marshal Montgomery, who achieved such success in the second world war, once said, ‘Man is still the first weapon of war’, this is the same in trading, our humanity and our mind’s capabilities, despite its limitation and flaws, are significantly more powerful than the most advanced computers.

Helpful behaviours to support development of this trait: Step back from the fray. Make time in advance for other interests and responsibilities. Practice ways to clear the mind and develop objective thinking and reflection. Focus on long-term goals and objectives. Focus on strategies and tactics to achieve long-term goals. Engage in activities which clear the mind; physical and mental activities. Keep an inspirational reminder article or object present to ground yourself. Talk to people, do not lock yourself away. Share your thoughts and feeling with a sympathetic listener, close friend, spouse or partner.

_________________________________________________________

Steven Goldstein is Managing Director at Alpha R Cubed, and work with banks, hedge funds and investment management firms to help them improve their people’s capabilities and performance. To know more about Alpha R Cubed, visit the website www.alpharcubed.com or email Steven at steven.goldstein@alpharcubed.com. Follow Steven directly on Twitter. Also visit the ‘Behavioural Trading’ blog for more articles and to sign up for the ‘Behavioural Trading’ newsletter.