Understanding your Trading Risk personality

4th February 2016

by Steven Goldstein

In my work as a performance coach working with traders, I find far too many traders and risk professionals lacking adequate levels of self-awareness. They have huge knowledge about ‘the enemy’, their market, however they suffer a dearth of knowledge about themselves. As Sun Tzu says, ‘If you know yourself but not the enemy, for every victory gained you will also suffer a defeat.’ In trading and investment terms, pretty poor performance. On the contrary, I find that traders who possess high levels of self-awareness are often winning their battles. In trading and investment terms, ‘outperforming the rest’.

I recall a coaching session with a trader from an investment bank in Hong Kong. Prior to the coaching I had been provided with some background by his manager. He was a very strong performer with an excellent track record. When the individual entered the room for our first meeting, I was somewhat underwhelmed as this rather unassuming slightly diminutive person entered. Within minutes of talking to him however, I realized that this individual was actually one of the smartest most self-aware persons I had ever come across. As it turned out, not only was this trader an outstanding performer but he was also a world top-200 poker player. Quite an achievement for a full time bank trader at the time. (He now works at a major hedge fund)

How Self-Awareness Makes You More Effective as a Trader and Investment Manager.

Self-awareness helps you understand more about your innate skills, your capabilities and your blind-spots. The self-aware trader is able to plug skill and behavioural gaps in their trading and risk activities and promote development of key skills. Self-aware traders direct their energy toward situations in which they will be most effective. In these situations, they are more likely to have an edge, which means they more likely to be able to exercise better intuitive decision making, will suffer less stress and will be more motivated.

Knowing your strengths and weaknesses: Self-awareness helps you exploit and leverage your strengths and better manage your weaknesses. A trader who is aware that they are strong at certain times or in certain situations can direct their energy to when those times and situations present themselves. This can lead to greater confidence in themselves to execute at the right time, and may enable them to be willing to risk a greater size. Equally a trader who is conscious about their weaknesses can start to take action to address this, either by working on their weaknesses or avoiding those situations where their weaknesses come to the fore. On the other hand, the less-self-aware trader is more likely to find themselves trading when they shouldn’t and failing to capitalize on situations when they should. This leads to lower levels of confidence, excuses for a failure to act, and repetitive and self-defeating behaviours.

Acting Intuitively: Traders with well-developed emotional self-awareness are often highly effective intuitive decision makers. In complex situations, such as financial markets, where there is high levels of uncertainty and too many unknown variables, highly intuitive decision makers are able to process large amounts of sometimes unstructured and ambiguous data, and choose a course of action based on a “gut feeling” or a “sense” of what’s the best option. Traders who are highly emotionally self-aware are able to read their “gut feelings” and use them to guide decisions, whilst regulating and managing their own emotions.

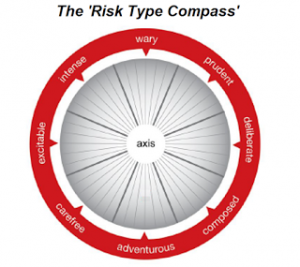

Stress avoidance’ or ‘Stress Reduction’: the self-aware trader is more likely to adopt methods or approaches which suit their personality. Approaches and methods that don’t suit your personality tend to give you more stress. Equally engaging in practices, tactics and strategies which are incompatible with your personality or character, are likely to lead to stress and sub-par performance. This is not to say that you should never engage in behaviours that conflicts with your personality. However, like writing with your left-hand if you are right handed, it will take a longer to develop competency and you are always likely to have to work extra hard to develop the skills you need for success. It is far better to align your methods and approaches to ways which may be less stressful for you. In my work I use a risk-profiling tool that categorizes all risk

professionals into one of eight different types of risk personality. There are certain behaviours and types of trading which appear to be incompatible with each risk type. For example the ‘Wary’ risk type is highly risk averse, they tend to be prefer shorter-term trading are highly tactical in their approach and typically like to use stops. On the contrary traders who fit the ‘Adventurous’ type are diametrically opposite the ‘Wary’ type, they are less analytical and more big-picture thinking, they tend to prefer a strategic longer-term approach and often like to fade the market. We have worked with many ‘discretionary’ traders of both types. Success is not necessarily more likely to be found among any particular type, what matters to success is that they are matching their style and approach to their type. Indeed the most successful individual, out of all the traders we have worked with thus far since we started testing our clients just over a year ago, is a ‘Wary’ type individual who is incredibly risk-averse. He has found an approach and style which suits his cautious risk-averse approach, and as a result has made over $100mio for his hedge fund in each of the past two years.

Motivation: Raised levels of self-awareness can have a profound effect on levels of motivation. A trader who feels helpless can become easily demotivated, however a trader who suddenly understands why they do the things they do, and can start do something about it starts to feel far more motivated. It’s very difficult to cope with poor results when you don’t understand what causes them. When you don’t know what behaviours to change to improve your performance, you just feel helpless. Self-awareness is empowering because it can reveal where the performance problems are and can indicate what can be done to improve performance.

Leadership, Management and Team Performance: Self-awareness is also a powerful attribute for leaders. When we understand “what make us tick” we have the insight to understand what makes others tick. To the extent that other people are like you (and, of course, there are limits to the similarity), knowing how to motivate yourself is tantamount to knowing how to motivate others. Strong manager, lead strong teams. Understanding the drivers of the members of the team can help optimally distribute resources around the team. Too many of members of the same type within a team can lead to ‘concentration risk’, whereas diversified skill-sets working in harmony can drive team performance forward.

Our coaching at AlphaRCubed is highly empowering to traders, because one of the key aspects of our work is to help raise people’s self-awareness. Our coaching has achieved some extraordinary outcomes in helping traders and investment professionals breakthrough performance ceilings, as was featured in this article here. No one truly knows themselves because, as Daniel Kahneman puts it, ‘We are all blind to our own blindnesses’. Our coaching provides objective feedback to individual, in a risk and financial market context. The reason this is so powerful with traders and investment managers, is not because the coach is smarter or has a better understanding of the job than the individual. Rather it is because the traders, being so much inside their own mind and the system they operate within, don’t question themselves in the way someone with an external perspective does. Being outside the system and getting an alternative perspective, helps people to see themselves as they’ve never seen themselves before. It is this, when done effectively, that helps the individual being coached achieve far greater levels of self-awareness. If you need not fear the results of a hundred battles, how much more ready will you be for the fight.

Steven Goldstein is a leading Performance and Executive Coach working with Traders, Banks and Hedge funds: He is Managing Director of at Alpha R Cubed, which works with banks and investment firms to improve their human capital within financial risk businesses. To know more about Alpha R Cubed, visit their website www.alpharcubed.com or email Steven at steven.goldstein@alpharcubed.com.