BTP’s – Sentiment remains Negative

6th December 2016

BTP’s – Sentiment remains Negative

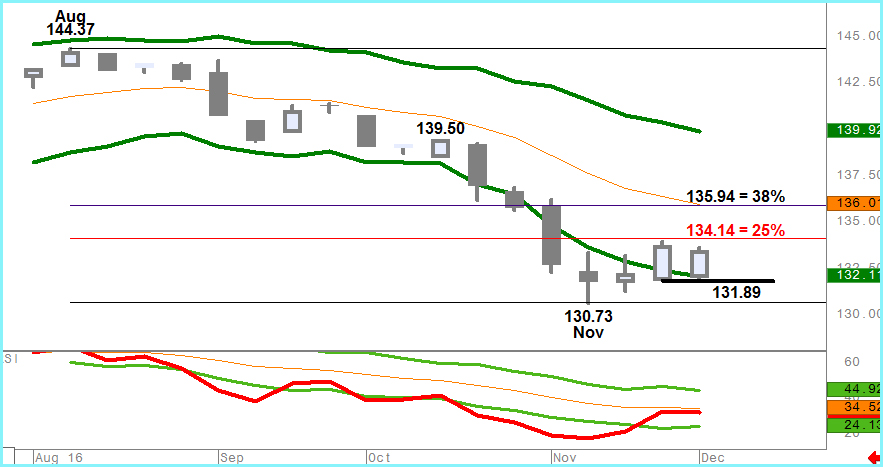

After falling almost 14 points from August’s high the BTP market has been trying to rally since November’s low. This week’s gains have the potential to produce a 3rd up week in a row.

However, the bounce remains a limited one in our view with last week’s demand stalling near a 25% correction to the Aug-Nov fall and this week’s gains yet to retest that point. That ‘weakness’ is further emphasised by the RSI indicator which, although off the lows, has yet to break above its own moving average (see chart 1).

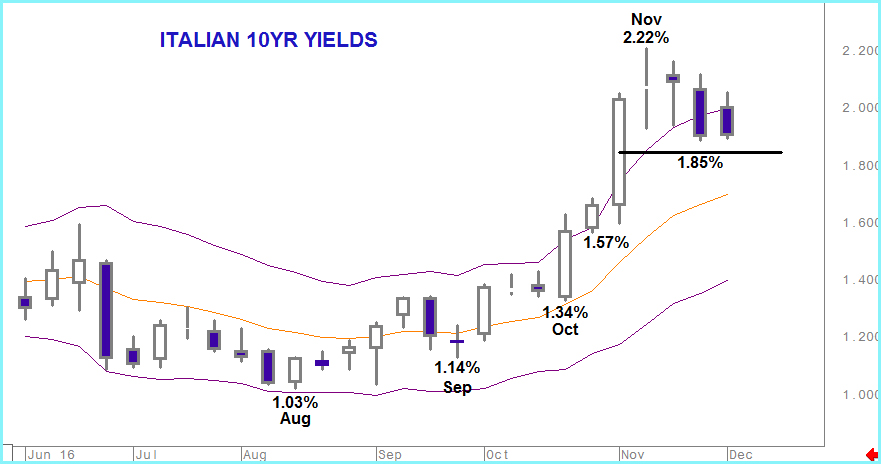

In addition the market remains close to the bottom of a weekly Keltner channel that remains angling lower and this is matched by yields which also remain near the top of their Keltner channel – interesting point to note here is a Marabuzo line created 4 weeks ago at 1.85% (chart 2)

This ties in with the yield spread against Germany where the current sharp setback is expected to find fresh buyers the trend of higher yields – marginally above 1.5%. There is potential here towards 2.00% though we’d expect to see some profit taking interest near that point (chart 3).

So, in the immediate term this correction has potential to stay as the background element but in the medium term we believe the negative tone for BTP futures will dominate.

Sellers are likely again near 134.14 and BTP downside has potential through 131.89 to November’s 130.73 base then towards projected points at 128.75 and 127.03. Only above 135.94 would call this bearish outlook into question.

Chart 1 – BTP’s make weak rally

Chart 2 – Italian 10 year Yields

Chart 3 – Italian/German Yield spread

‘