Using Keltner channels in short term trading

17th June 2015

As those of you who’ve read our analysis on a regular basis will know we very often refer to Keltner channels as a way of defining a trend. This applies whether it’s a long term or intraday trend and their effectiveness, when used in conjunction with other technical indicators and in the context of market price action, cannot be over-estimated.

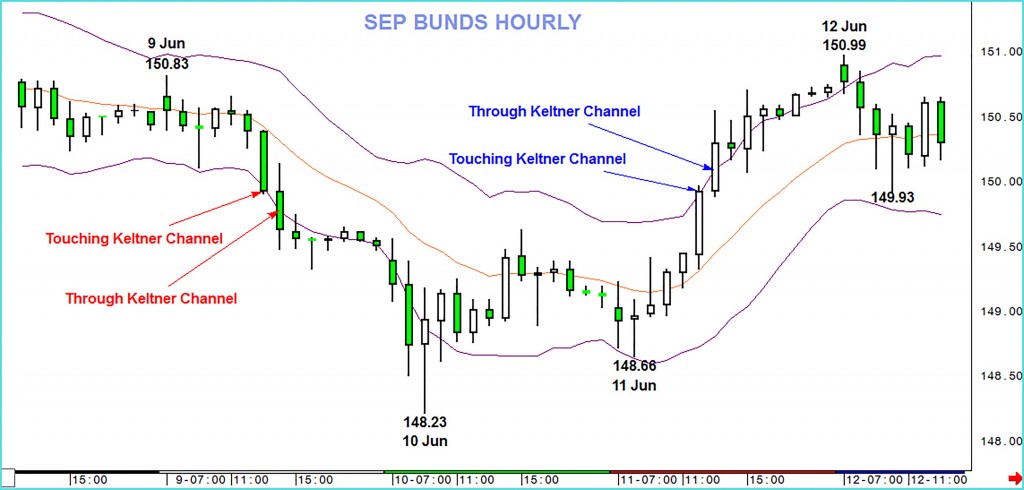

Here I’d like to show an example of how they could have been applied in a short term perspective recently using an Hourly Sep BUND chart.

Firstly the chart below covers the period between June 9th and 12th.

In the afternoon of the 9th Bunds are sold sharply and close touching the lower end of what is now a declining Keltner channel. This indicates a bearish trending market but what I wish to emphasise is that the strength of the trend can be further gauged when/if spot prices move below that parameter. This is what happens here and, barring some consolidation in the last few hours of the session, selling pressure extends in the first 3 hours of the following day.

After the market bounces from the lows a new positive trend is signalled by the upper end of the Keltner channel, as the market enters the afternoon of the 11th, then emphasised as prices move and close outside the upper band.

Now let’s wind back time to the beginning of the month.

The early move is an increasingly negative tone to Bunds which is signalled by the touching of the base of the channel, then emphasised as in the first instance mentioned (June 9th).

What I’d like to point out here is that prices sold off strongly over 3 days, and the first 3 hours of the 4th, but although minor profit taking rallies were seen they were limited by the mid-point of the channel – marked in orange.

Finally I’d like to draw attention to the 2 points marked in blue that occurred during June 5th. Why were these not selling points?

The reason is that the Keltner channel is not trending lower. It is moving sideways and so I’d look for a 2nd hour to keep prices at the lower end as confirmation, especially as that would then likely lead to the ‘tram lines’ of the channel bending lower. This didn’t happen of course with the 2nd bounce from the lows emphasising a lack of negative momentum.

I hope this taster of how Keltner channels can aid short term trading will whet your appetite to try them for yourselves.