Weak USDTRY Dip Emphasises Trend

23rd June 2015

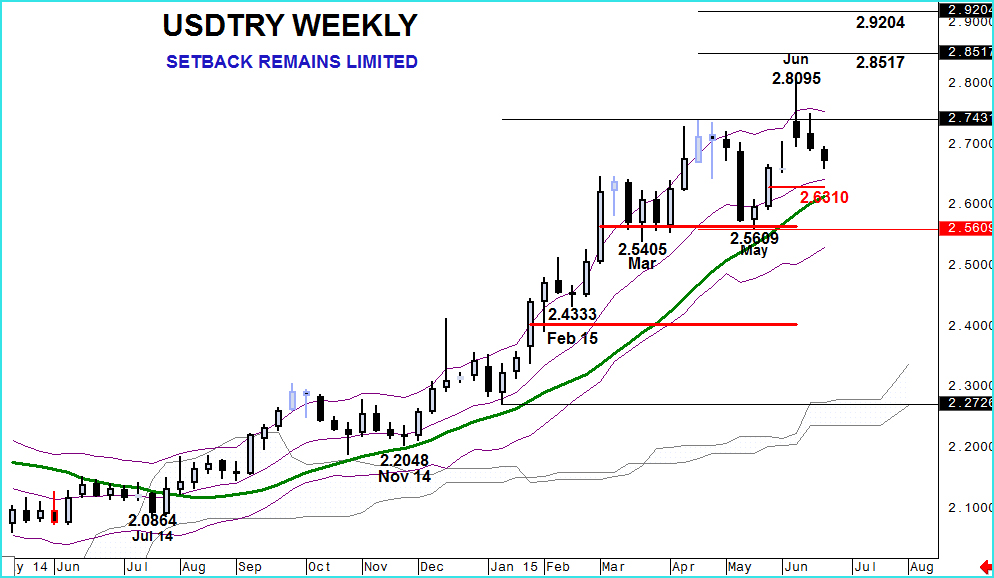

We’ve written previously about the aid that Marabuzo lines have been in trading USDTRY during the course of this year. That remains the case but the 2 weeks previous to this have attracted profit taking and this week has, so far, also seen selling pressure. So are we seeing the end of the bull trend?

At the moment I don’t think so as the reactive move lower is a natural even after the scope of the gains seen this year, and the longer term move since July 2014. And so I think it is wise to look at what has defined that move of more than 72 big figures.

Personally, bar looking for the obvious – sequentially higher lows and highs – I look for moving averages and the Keltner channels.

Here is USDTRY we can see that the relevant moving average for this time period, in my opinion, is 21 weeks and the crossover of this point back in July 2014 was a strong indication of the developing bull trend. That point has been unthreatened since.

Secondly, at time of the moving average crossover the weekly Keltner channel was flat but this soon became positive with prices hugging the upper band of that channel during September, December then February through to May. Setbacks from that upper band have. Broadly, been contained by the mid-point which is the 13 week average. Again, although prices are coming off currently, the mid-point of the channel is still holding.

So currently we consider the bull trend to be intact with scope to 2.8517 or even 2.9204. Only a serious test of the 13 week line could lead to re-consideration.