Commentary

3c Analysis Commentary Page - Adding Value

On these pages we will expand upon some of our forecasts, talk about other moving markets from a technical analysis perspective, explain technical analysis tools from a practical perspective and include guest commentary from a variety of roles across the financial markets.

We’ve written previously about the aid that Marabuzo lines have been in trading USDTRY during the course of this year. That remains the case but the 2 weeks previous to this have attracted profit taking and this week has, so far, also seen selling pressure. So are we seeing the end of the bull trend? At... read more

Although lower levels were posted last week for a 2nd week in succession, and net losses produced, the real USDCAD story was less clear.The downside stalled, and found buyers, near a 50% pullback point and a Marabuzo line created 4 weeks previously. The subsequent bounce regained more than half of the initial downside.However demand lacked the... read more

Back in January a break below the 21 week moving average and bearish triggers in both RSI and Momentum yielded 3 weeks of strong selling pressure in CADJPY– 8 big figures. This was followed by a broad consolidation phase that was capped by a weekly Marabuzo line while Momentum and Strength was rebuilt. try our analysisMomentum was... read more

As those of you who’ve read our analysis on a regular basis will know we very often refer to Keltner channels as a way of defining a trend. This applies whether it’s a long term or intraday trend and their effectiveness, when used in conjunction with other technical indicators and in the context of market price... read more

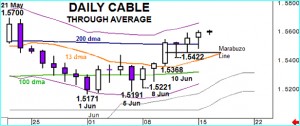

A sequence of 3 lower CABLE highs ended last week. The preceding week's stalling at a 50% correction level proved crucial and as buying became more pronounced. In fact gains of almost 3 big figures turned weekly sentiment clearly positive, especially with the market bought at higher levels on each of the last 6 days and... read more