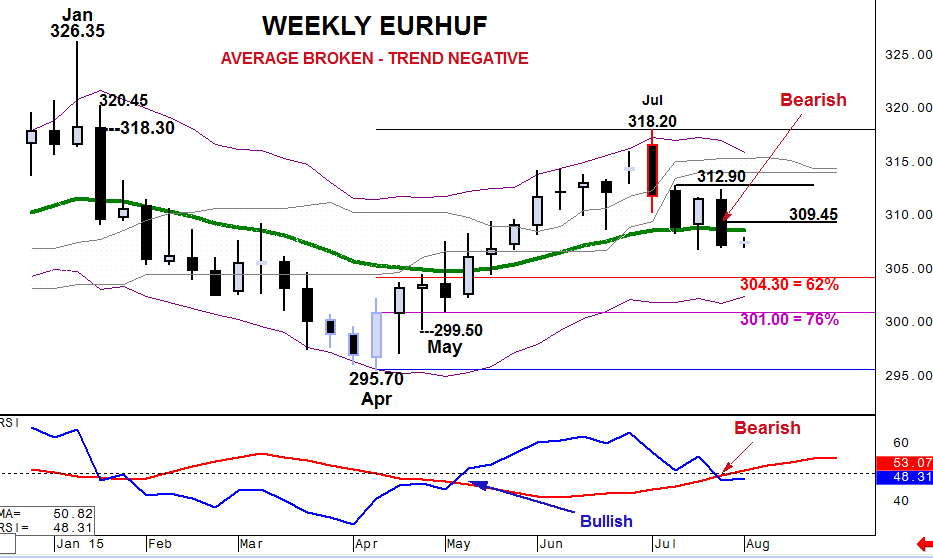

EURHUF give bearish triggers

3rd August 2015

After peaking at the top of the daily Keltner channel, at lower levels than January, three of the last four weeks have posted net losses in EURHUF. More importantly, after stalling at the 21 week moving average for 2 weeks, last week saw an acceleration of selling pressure. We look for the downside to develop in the coming weeks because;

- The cross is now at the most negative levels traded since May.

- Momentum is negative.

- Lower weekly highs.

- RSI has broken down through its moving average.

The last time RSI was broken from a bearish perspective spot prices fell by more than 14 big figures and 3cAnalysis EURHUF signals for sentiment indicate the decline will deepen.

Rallies are likely to be confined below 309.45 with downside potential to 304.30 and 301.00, corrections of 62% and 76% of the rise from April’s low. The risk level is currently assessed as 312.90.