Why it’s not easy to move EURUSD outside its 2-year range

1st March 2017

Why it’s not easy to move EURUSD outside its 2-year range – A guest article

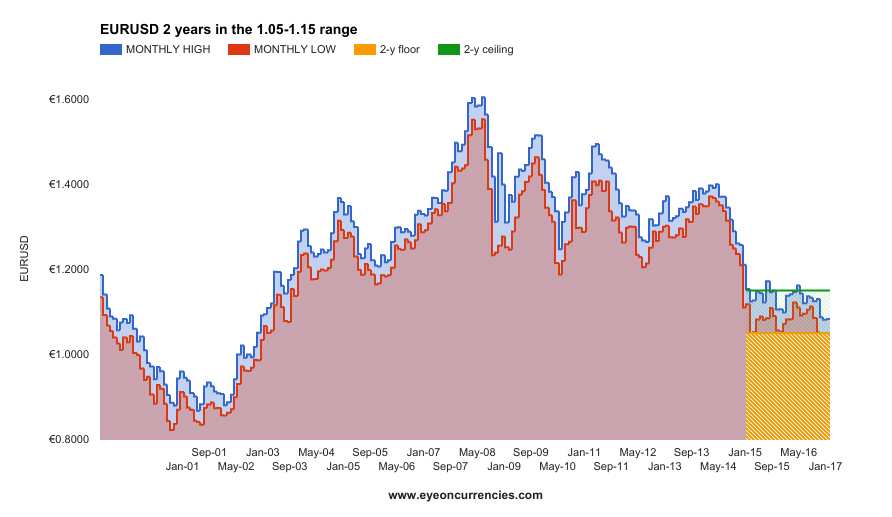

With the exemption of a few short-lived spikes and dips, EURUSD has over the last 24 months kept the range 1.05-1.15 – a long stretch with remarkable little volatility for a currency pair that has had its fair share of challenges despite being no more than a teenager.

Having witnessed the pair’s birth around 1.15, seen a low down by the 0.80 level two years later and a high by 1.60 just before the Lehmann Brothers collapse – a 1000 pips range during a period when ECB measures and those of the Fed diverted more than ever, when questions about the future of the European Union were highlighted through Brexit, the possibility of a Grexit, a Nexit and a Frexit – is just remarkable.

There are lots of reasons why this range could be challenged. Negative Euro area interest rates, printing of euros, economic growth prospects that are generally seen to be slow, fragile and uneven – as Mario Draghi would have said it, a banking sector in need of capital, upcoming parliament elections in several European countries that might give EU sceptics more influence and even the mandate to call for referendums on EU membership, politics weighted more towards preserving sovereignty at the expense of European unity, growing scepticism to globalisation, populism challenging establishment and drawing the constitutional card whenever convenient. These are all strong arguments why the floor level by 1.05 for EURUSD should have been challenged over the last two years.

So – why is it that it holds as well as it does? First of all – the level is not protected in any way. It is not a floor level for ECB interventions to support the Euro. To the contrary – the ECB would likely be happy to see EURUSD at a lower level than it is. The answer lies in the support which corporates are providing. Just look at Euro area trade balances and current account surpluses and you will see how big corporate sectors are as net buyers of Euros. That has been the case for the last three years and it will continue for as long as the euro stays as low as it does. In fact – the lower it goes, the more euros these sectors will buy – and hence – the more of a floor level they in reality provide.

The ECB has provided the financial sector with a lot of cash through their asset purchase program. Parts of that cash has been provided to short-term speculators, happy to be short in EURUSD from the measures the ECB has put in place and the distance between Euro area interest rates and USD interest rates.

Without these measures, EURUSD likely would have been much higher and likely higher than the ceiling level of 1.15 we have had over the last two years. That 1.15 still has worked as a ceiling is predominantly because speculative shorts have felt comfortable that their positions are supported by the actions of two central banks, that the US economy has better growth prospect than that of the Euro area and that US inflation is higher than what is the case in Europe.

The bottom line is that two central banks are capping the upside for EURUSD and corporate sectors are providing the floor level. The volumes acting as support and resistance are substantial – into several hundred billion for the pair.

For EURUSD to make a sustainable move outside the 1.05-1.15 range, one needs massive volume changing hands as the EURUSD price doesn’t move by itself. Speculative funds will likely not be able to push EURUSD lower by themselves as they are already massively short. They are up against corporate sectors vacuuming the market for euros – and more so the lower it goes.

There is in my view a higher risk that a major break could come to the upside – from speculative funds losing their patience, vulnerable as they classically are.

But – as the 3-4 months to come will fuel markets with so much of uncertainty, mainly through European elections, speculative shorts likely will feel secure and stay put. They are also supported by the policies of two central banks.

Should European elections give more or less an unchanged political landscape within the Euro area – then I would put my bets on a significant move for EURUSD to the upside. That move could take us far and there would be little central banks could do about it as massive short positions will be turned around. There will be no help for speculators from corporate sectors. They will be buyers themselves – until the EURUSD has reached such a high level that trade balance and current account turns negative. By such time, a peak level for the pair will take shape.

Should – on the other hand – European elections bring the European Union into a political storm with threats of defections from more countries than the UK, then it is all down to whether the ECB has the tools in place and the authority to act. That would take us into scenarios for which we have no experience or references of value. If a floor level is found, I think it would not be much lower than it is today. The question is more whether we will have a floor level at all.