CADJPY – Rally to attract Sellers?

22nd January 2016

…

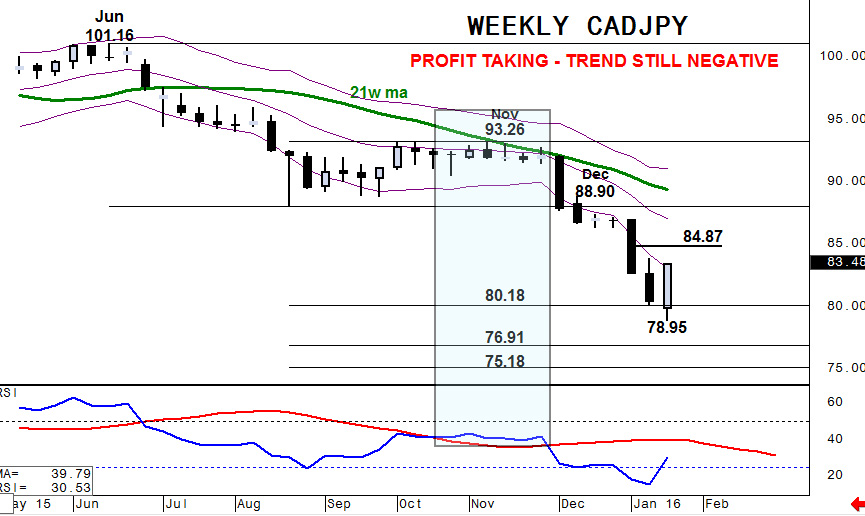

The negative trend in CADJPY is well established with a downside break of the important 21 week moving average, and the RSI of its own average, in July last year.

CADJPY prices have dropped, to their low, 19 big figures since. The only true threat to that negativity was in November when a profit taking rally took the RSI indicator above its average. But that move was not confirmed by the spot which failed to close above, weekly basis, either the 21 week line or the middle of the weekly Keltner channel.

The subsequent renewal of selling pressure was sharp and immediately took CADJPY through the lower end of an increasingly negative channel – always a clear signal of a strong trend.

This week has seen a powerful rally, after posting the most negative levels traded since 2012. These gains are the most aggressive since the last significant bottom in February last year. That, coupled with a more positive RSI, has to be a concern to bears but there is no confirmation in either the RSI or the spot price which is a long way from the key average and only just sneaking back inside the Keltner channel.

So for the moment we maintain a bearish bias for CADJPY looking for a Marabuzo line at 84.87 to attract fresh selling interest but keeping a wary eye in the coming weeks on the 21 week average.

A renewal of the downside would probably be signalled by a move below the Marabuzo line that will be created by this week’s price action (half of the net gains at the NYK close) and confirmed by a move through this week’s base.

Below that, projected levels include 76.91 and 75.18.